It was just a few years ago when a leading global consulting firm noted in their financial services outlook, that the “industry would switch gears from defensive compliance remediation to a proactive search for revenue growth and further cost reduction.” As topline growth stayed modest over the years, banks focused mostly on operational efficiencies to drive financial performance improvements. As an example, they looked for scale efficiencies through rationalizing their branch networks with only mixed results. Banks are very complex organizations, but as IT and Finance collaborate more to redefine their role and value, optimizing IT cost as a driver to improve the bank’s Efficiency Ratio will become a way to break down institutional barriers to success.

For those of you who don’t work with financial metrics daily, you may be wondering what the Efficiency Ratio is, and how is it calculated? It’s calculated by dividing the bank’s Non-Interest Expenses by their Net Income. In other words, the Efficiency Ratio with 50% being optimal, indicates whether banks have an efficient cost structure. Most banks that are considered ‘efficient’ operate between 50% and 60%, and measure this as a part of their earnings statements. For example, as of this writing Citigroup has an Efficiency rating of 56%, whereas PNC Bank is 76%. Here we would conclude that Citigroup is better managing their cost structure because Citigroup’s expense is only 56% of their net income, as opposed to 76% for PNC.

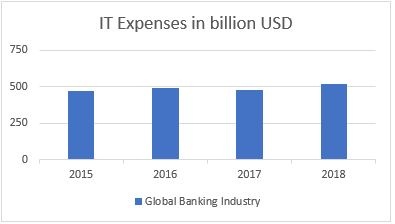

Besides buildings and employees, the largest expense line item for a bank is related to the costs associated with technology. To put some numbers in perspective, the worldwide IT spending forecast for 2018 is $3.7T, of which the global banking industry will consume 14%, or $519B.

And where is that $519B spent? Banks have an expensive legacy IT infrastructure in place that is comprised of a hodgepodge of systems, platforms, software and tools that demand significant resources to ensure that operations run smoothly. Recent statistics show that 80% of banks’ IT budgets are used to maintain legacy systems, or just ‘running the bank’. Of the remaining 20%, roughly 15% of spend is related to obligatory compliance projects meaning that only 5% of the banks’ IT budget is spend on innovative non-regulatory change.

Bottom line is that banks will have to balance two key IT strategies:

- Running the bank

- Transforming the bank

There is a good reason Steven Zolman, Founder of NET(net), in his January blog post titled, The Mainframe That Ate My P&L, referred to Financial Services Technology Groups as the “heroes” within their organizations.

Besides the high cost to run the current IT operations, banks are also facing disruption. Looking at the 4 States of Disruption (Durability, Viability, Vulnerability and Volatility), banks are in the Volatility state, meaning they experience high levels of disruption and are susceptible to even more disruption in the short term. For companies in the Volatility state, decisively changing the current course and moving fast enough to withstand the innovations of their competitors, is the only way to survive.

The financial services industry just experienced the largest crisis of the past 75 years. On top of that, banks are facing the challenge of trying to shift money from ‘legacy cost’ to ‘innovation’, as they struggle to fend off disruptors to the market that are not straddled with the same operational challenges. No wonder they are looking for alternatives. Finding ways to reduce legacy IT operating expenses to improve the Efficiency Ratio and to free up money to invest in: Going Digital, Blockchain, Customer Intelligence, Robotics & AI and Cyber Security, is front and center for banks in 2018 as they demand more value from their IT spend.

Warren Buffett once famously said, “Money is what you pay; Value is what you get.” All too often we see that Banks are focused on performance with their technology suppliers and neglect the value component to their detriment. Getting more value from suppliers is where the opportunity for transformation lives. A great example of this is around MCO (Mainframe Consumption Optimization). As most Banks focus on keeping up with demand while delivering flawless performance for its customers, they neglect the corresponding rise in costs associated with mainframe consumption. Suppliers are more than happy with this arrangement and make it all to easy to facilitate growing usage. (MCO) is a way for banks to dramatically reduce IT expenses and shift operational expense over to innovation. Major technology suppliers can help with this, but only if properly motivated and managed.

Besides MCO, Cost Optimization across the portfolio of IT spend is another opportunity to capture value, but only if you know how, and only if you’re paying attention to it. Almost all companies are overspending by 32% to 60% on various supplier agreements versus the market average, which can mean hundreds of millions depending on the size of spend.

Connect with NET(net) to build out a long-term IT Cost Optimization plan which can include MCO, and start getting more value from your IT investments, agreements, and relationships. Our subject matter experts average 25 years each of experience each and draw from NET(net)’s 15 years of Federated Market Intelligence to ensure you get the best market pricing across all technologies and suppliers. Visit netnetweb.com to see what our clients say about working with us.

About NET(net)

Celebrating 15 years, NET(net) is the world’s leading IT Investment Optimization firm, helping clients find, get and keep more economic and strategic value. With over 2,500 clients around the world in nearly all industries and geographies, and with the experience of over 25,000 field engagements with over 250 technology suppliers in XaaS, Cloud, Hardware, Software, Services, Healthcare, Outsourcing, Infrastructure, Telecommunications, and other areas of IT spend, resulting in incremental client captured value in excess of $250 billion since 2002. NET(net) has the expertise you need, the experience you want, and the performance you demand. Contact us today at info@netnetweb.com, visit us online at www.netnetweb.com, or call us at +1-866-2-NET-net to see if we can help you capture more value in your IT investments, agreements, and relationships.

NET(net)’s Website/Blogs/Articles and other content is subject to NET(net)’s legal terms offered for general information purposes only, and while NET(net) may offer views and opinions regarding the subject matter, such views and opinions are not intended to malign or disparage any other company or other individual or group.